-

Apexlink

Real Estate

-

DLS

General Insurance

-

DMV

Government

-

Entiger

Fintech

-

GIS Mapping

Gas & Petroleum

-

HMS

Employee Benefit

-

HAWA

Government

-

Harley

Community

-

IHG

Hotel & Tourism

-

Sparkseeker

Humane Tech

-

Track Ninja

Sports

-

Response Vision

Disaster Management

- Artificial Intelligence

- Application Services

- Automation Services

- Cyber Security

- Chatbot Experts

- Data Analysis

- Data Warehouse Services

- Machine Learning

- Digital Commerce Services

- Digital Transformation

- Infrastructure Service

- IT Support

- IT Consulting

- IT Outsourcing

- IOS Development

- Android Development

-

Cross Platform Development

-

Gaming App Development

One of the most talked about innovative developments in the context of financial technology is robo advisory. Not only are robo advisors heavily influencing our thoughts about investing but they are also transforming how the entire financial sector operates. In fact, according to some recent reports, the robo advisor app development market is expected to reach $2,274 billion and the number of users, too, is expected to cross 24.020 million users by 2027.

What exactly are robo advisory services?

Automated investment platforms that leverage technologies like artificial intelligence & machine learning to create algorithms that facilitate smarter financial management are known as robo advisory software. These robot advisors platform are specifically beneficial for people who are new or have limited knowledge about the market.

Robo advisor platforms use information related to users’ investment goals and risk appetite among other important factors to create an investment portfolio that matches their needs. The data recorded by the robo-advisors apps can be later used to keep a check on investments and adjust the balance to for risk optimization.

Fundamental Components of a Robo-Advisor

A number of elements need to work in synchronization with one another to ensure that a robo advisor software is doing its job right. These include money management algorithms, financial APIs, backend system management, and portal for partners. Let’s take a quick look at each of these.

Money management algorithms help offer multiple portfolio options to the clients to suit their specific goals and investment preferences. The algorithms are designed to analyze factors such as goals, investment ability, and risk tolerance for efficient portfolio creation and management. The algorithms can also be trained to provide additional features like tax loss harvesting, loan management, and more to offer a fuller range of services.

The front end of the robo advisor app fintech products needs to be user friendly. Generally, a robo-advisor is a mobile or web app that facilitates client onboarding, investment tracking, and more.

Financial APIs help ensure proper functioning of the robo-advisors by allowing automated management of long-term investments upon integration with bank accounts. Financial APIs are responsible for handling trades execution, portfolio balances, and third-party integrations, and thus, play a foundational role in offering personalized financial advice to the clients.

If you plan on offering competitive 401(K) plans to your customers through robo advisor solutions, it is imperative that you develop a separate portal for partners that lets you track balances and payments.

When you are building a fintech software as robust as a robo-advisor, you will need a solid backend that supports it. It will not only monitor the overall performance of the robo-advisor, but also supervise the investment algorithm.

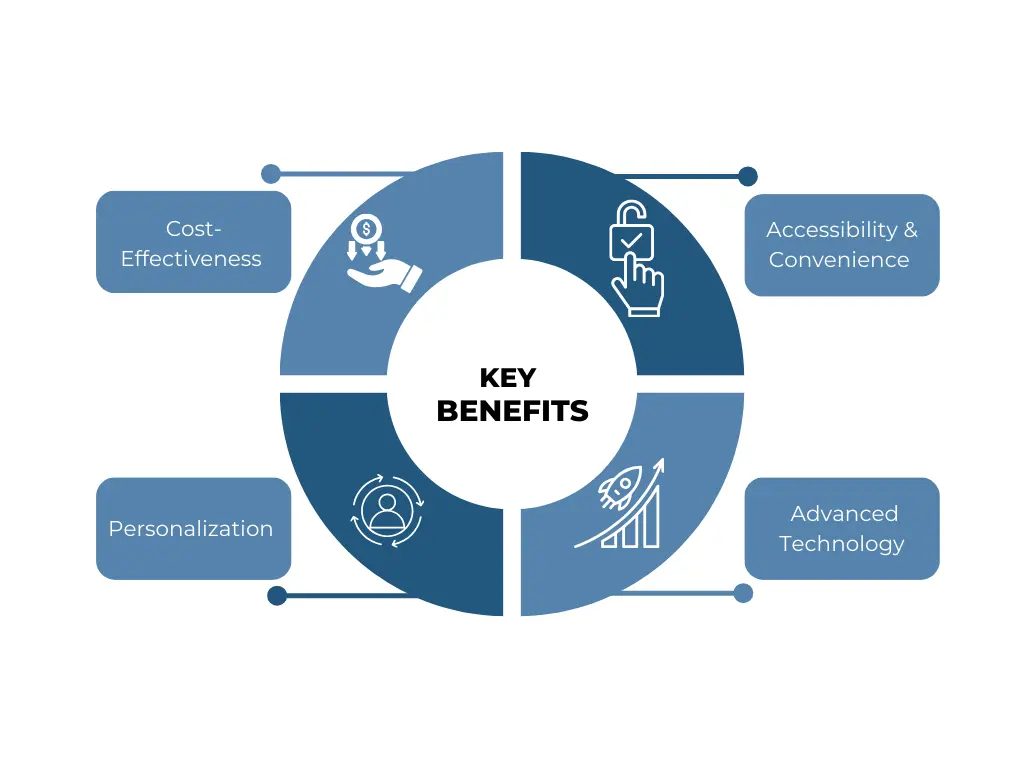

Key Benefits of Robo-Advisors

There are a number of reasons why robo advisor fintech products have the spotlight on them:

Cost-Effectiveness

Most robo advisor platforms have a very low account minimum which makes it easier for individuals with small amounts of capital to start investing. In addition to that, robo-advisors charge a lower fee than traditional advisors, making it a more cost-efficient option.

Accessibility & Convenience

Robo-advisor app development experts build features that let users manage their investments at any time throughout the day, offering unparalleled accessibility and convenience.

Personalization

Since robo advisory firms heavily rely on user inputs for creating a portfolio, their suggestions are more tailored and personalized. Also, making adjustments and continuous monitoring is comparatively easier when using a robo-advisor.

Advanced Technology

Robo-advisors use sophisticated algorithms to make investment decisions, and that leads to more consistent and unbiased outcomes. Additionally, many robo-advisors offer tax-loss harvesting by strategically selling losing investments to offset gains and minimize taxes. The technology in robo advisor platform development combined with a user-friendly interface makes investing accessible and convenient for those with limited financial knowledge.

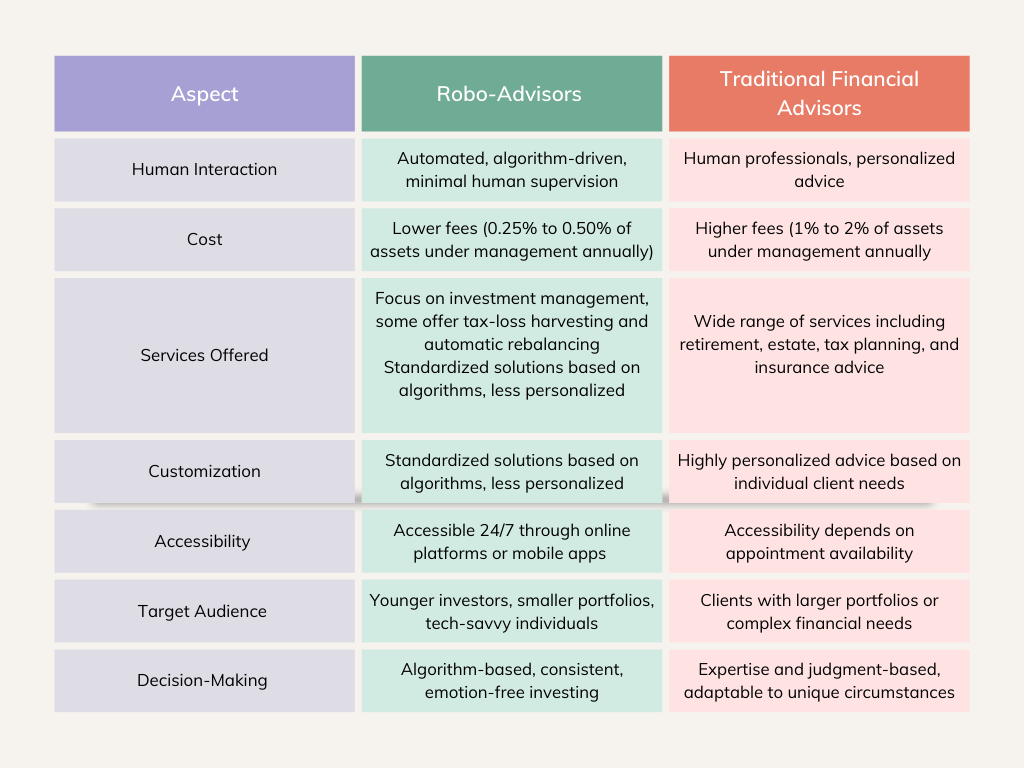

How are Robo-Advisors Different from Traditional Financial Advisors?

Robo-advisors and traditional financial advisors offer distinct approaches to financial management. Robo-advisors are automated, algorithm-driven platforms that provide low-cost, standardized investment management with minimal human interaction, making them accessible 24/7 and ideal for younger, tech-savvy investors with smaller portfolios. In contrast, traditional financial advisors offer personalized, comprehensive financial services, including retirement and tax planning, through direct human interaction. They charge higher fees for their tailored advice and are suited for clients with larger portfolios or more complex financial needs. While robo advisor app development ensures consistent, emotion-free investing, traditional advisors leverage their expertise and judgment to adapt strategies to unique client circumstances.

Seasia Infotech’s Approach Towards Robo Advisor App Development

Building a robo-advisor as a part of fintech software development involves several essential steps. First, you need to conceptualize and plan, identifying your target audience and defining key features for your robo-advisory software. Ensuring regulatory compliance is crucial at this stage. Next, partner with a fintech app development company to develop your investment algorithms based on financial theories and create a risk assessment questionnaire for users.

The next step is finalizing your technology stack, deciding between a web-based application or a mobile app, and using technologies like Python or Java for backend development and React or Angular for the frontend. We also support integrating financial data providers for real-time market data and building robust APIs and databases.

Security and compliance are critical, so implementing strong encryption and adhering to KYC and AML requirements is a part of Seasia Infotech’s robo-advisor app development approach. In fintech app development, it is also important to design an intuitive user interface and ensure a seamless user experience. Next up, we test your algorithms with historical data, conduct usability and security testing, and launch a beta version to gather feedback.

The final steps include creating a marketing strategy to attract users, and after launch, providing robust customer support and regularly updating the platform with new features and security patches. We finalize your application development process by continuously monitoring and adjusting the investment algorithms to ensure optimal performance. Our fintech development experts follow these steps to build a functional and compliant robo-advisor platform for you.

How Can We Help

There are numerous benefits of introducing robo-advisors to your financial services offerings. These include lower costs, ease of use, accessibility, personalized investment strategies, transparency, scalability, data analysis, and what not!

Do you want to strengthen your presence in the fintech industry and enhance your service offerings with robo advisor app development? The app development experts at Seasia Infotech can help you create an intelligent and customized robo advisor platform!

Frequently Asked Questions

What is the future of the robo-advisor platform?

The future of robo-advisors will largely depend on the public sentiment towards automated financial management. Considering the pace at which artificial intelligence solutions and machine learning technologies are advancing, robo-advisors are expected to become more capable and efficient. We are confident that robo advisor application development will witness increased adoption and a transition towards more personalized investment management services through robo-advisors in the coming few years.

Is robo-advisor worth it?

Robo-advisor application development is totally a worthwhile investment if you operate in the finance industry, thanks to their cost-effectiveness, better accessibility, scalability, and flexibility. Additionally, they can also be integrated with human advisors if you want to offer your clients a hybrid approach that combines the benefits of automation with the personal touch of human advice.

How much does a robo advisor platform app development cost?

The average cost of a robo-advisor platform development typically lies between $35,000 to $150,000.

How big is the robo-advisor market?

The robo-advisory software market is expected to reach $11.52 billion this year and $45.75 billion by 2029.

What is the ROI of a robo-advisor?

Robo-advisor applications are generally considered to be high RoI investments because of how cost-efficient and accessible they are.

Artificial Intelligence

Artificial Intelligence

Blockchain

Blockchain Cloud Computing

Cloud Computing Infrastructure

Services

Infrastructure

Services Metaverse

Metaverse QA

Automation

QA

Automation UI/UX

UI/UX