-

Apexlink

Real Estate

-

DLS

General Insurance

-

DMV

Government

-

Entiger

Fintech

-

GIS Mapping

Gas & Petroleum

-

HMS

Employee Benefit

-

HAWA

Government

-

Harley

Community

-

IHG

Hotel & Tourism

-

Sparkseeker

Humane Tech

-

Track Ninja

Sports

-

Response Vision

Disaster Management

- Artificial Intelligence

- Application Services

- Automation Services

- Cyber Security

- Chatbot Experts

- Data Analysis

- Data Warehouse Services

- Machine Learning

- Digital Commerce Services

- Digital Transformation

- Infrastructure Service

- IT Support

- IT Consulting

- IT Outsourcing

- IOS Development

- Android Development

-

Cross Platform Development

-

Gaming App Development

Mobile Banking App Development – Give your users the freedom to choose how they bank!

Long gone are the days when people used to go to the bank to cash checks. Now, money is deposited, spent, exchanged, and saved electronically, so much so that only 8% of the total world money is available in physical form.

The rest of it? Well, it is available electronically at your disposal with a few simple clicks. One technical advancement that has been helping with the quick adoption of online transactions is mobile banking app development. The convenience of being able to use your phone, something you always keep with you, to meet your banking needs.

However, every innovation comes with its own set of issues, and when money is involved, these concerns are vastly more important to address and control, especially when the concerns involve thievery, scams, and fraud.

The user-centric approach and ease of use make mobile banking apps a must-have for all banks. But because finances are involved, regulation and protection are mandatory to build trust and ensure quick adoption.

Mobile Banking Application Market

The world is moving towards digitalization, and the banking sector is no different. People worldwide are opting to use the online payment options. However, this does not only mean the rise in banking apps. Other payment methods like Apple Pay, Amazon Wallet, PayPal, and more are also gaining traction thanks to their ease of use.

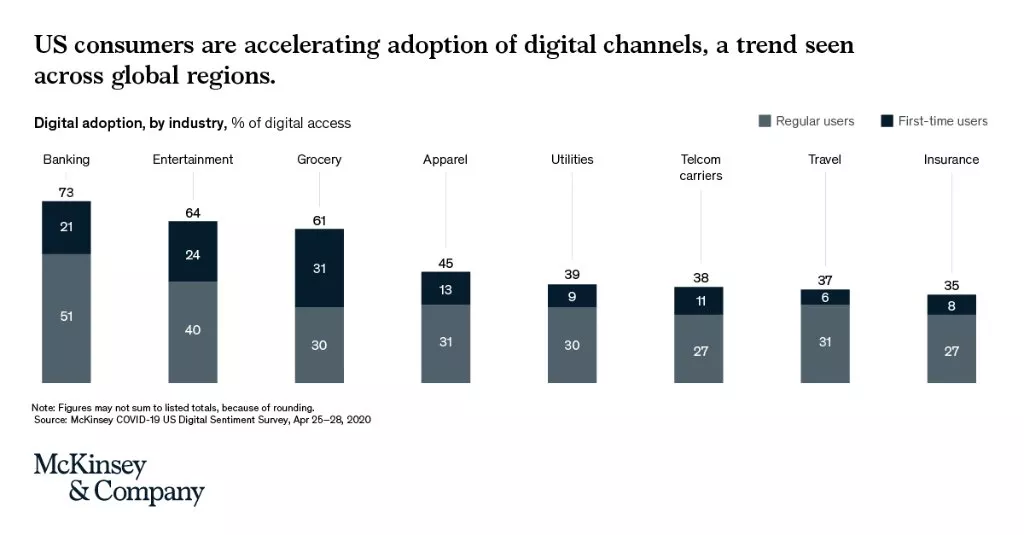

However, as a major player in the banking sector, the organizations responsible for all monetary transactions would like some control over the matter. Currently, the banking sector has experienced 73% digital adoption as per McKinsey & Company of 2020.

Mobile Banking App Market Overview

Why is the Banking Sector Moving towards Mobile Banking app Services?

The banking sector is moving towards mobile banking app development services primarily due to the fast pace at which people are spending money. The presence of mobile application development for banking is making it possible for organizations to offer services that people of the yesteryears could not imagine, including:

- Access to banking services 24/7

- Transaction history and details at the user’s fingertips

- Cashless deposits

- Unparalleled security practices

- One-click payments

- Ease of money transfers

- Online loan payments

It is not only the people who benefit from the digitalization of the banking sector. Financial institutes also enjoy several benefits when they build their own banking app, such as:

- Reduction in the overall cost of operating expenses

- Improved customer experience

- Better return on investment

- Push notifications, enabling more sales

- Personalized services using AI

Now, mobile banking apps are not only a novelty but a necessity for the financial sector as customers expect convenience.

What Demographic of people is using Mobile Banking?

While the older generations are still trying to grasp the full potential of online banking options, the younger generations are adopting the new technology with ease. Millennials and Gen Z are two segments that are primarily using online banking applications to manage their financial endeavors.

As the years progress and the tech-savvy demography increases, the financial systems will need to move towards digitalization to ensure survival.

This shift will allow banks and other members of the financial sector to offer a more customer-centric approach while ensuring frictionless operations.

8 Must-have Features for Mobile Banking app in 2023

When it comes to mobile banking app development, you must know the must-have features for the final product.

1. Enable Secure Authentication

Safety of user data is a non-negotiable aspect in today’s tech-forward world. As banking apps generally involve money, there must be multi-factor authentication, and other security measures to ensure complete control of the user. Generally, these applications include usernames and passwords, along with phone or email verification to avoid breaches.

2. Managing Your Account

A user-friendly interface is essential. The ideal mobile banking app will enable users to view their account summary, recent transactions, and account statements effortlessly. Additional features can include fund transfers between accounts, balance inquiries, and transaction history, enhancing the user experience.

3. Payments

Seamless and secure payment options are mandatory for all mobile banking apps. Currently, the applications available in the market support various payment methods, including peer-to-peer transfers, bill payments, and online purchases.

4. Push Notifications

Notifications that popup on the mobile phone can help banking sector keep their users informed about the latest are crucial for keeping users informed about their account activities. It can include information on successful transactions, upcoming bills, or security alerts. Push notifications can help with user engagement and provide real-time updates.

5. Customer Support

Exceptional customer service can set a mobile banking app apart from its competitors. Incorporating an in-app chat feature or a 24/7 customer IT support hotline enables users to resolve issues promptly. A comprehensive FAQ section can address common queries, ensuring that users find solutions to their problems without having to contact support.

6. Physical Branch Locator

Despite the digital age, users may occasionally require in-person assistance. Integrating a physical branch locator feature using GPS technology can help users find the nearest bank branch or ATM. This feature fosters trust, assuring users that they have access to traditional banking services whenever needed.

7. Regulatory Compliance

Adhering to regulatory standards and data protection laws is non-negotiable. Mobile banking apps must comply with international and regional regulations to safeguard user data and maintain the trust of their customer base. Regular security audits and compliance checks are necessary to ensure that the app remains up-to-date with the latest legal requirements.

8. Intuitive User Experience

Last but not least, the user interface should be intuitive and aesthetically pleasing. A well-designed app with easy navigation and a visually appealing layout enhances user satisfaction. Investing in user experience (UX) research and design can lead to higher user retention rates and positive reviews, driving the app's popularity.

Other Mobile Banking app Features that Banks Should Add at their Discretion

The above-mentioned are only some of the several features that a bank can offer. To make it more viable for the customers, financial institutes can add the following features based on their preferences and end goals.

Personalized Offers: Provides special offers that meet the demands of particular individuals based on their activities. It can include loan offers, credit cards with specific benefits, and more.

Wearables: Some banking apps today can be linked with wearables, like a smartwatch, where the user can get relevant information delivered to them.

Expense Charts: Giving your users the option to become educated on spending is always welcomed by the customers. An expense tracker detailing the types of spending that the person is doing monthly, weekly, or yearly can provide them with needed insights and improve their customer experience.

Cashback services: People love cashback. Banks can leverage the system to ensure that the users directly make purchases from the application while earning the users’ loyalty.

Blockchain: Considering the current market and move towards blockchain services, especially in the financial sector, mobile applications can offer better speed, accuracy, and security using the latest technologies. Of course, it can include cryptocurrency services if needed.

Bill-splits: One of the lesser-known features that might add to your application’s unique experience is offering a bill-splitting option, where friends can request payments for shared expenses.

Digital Wallet: Integrating real-time payment gateways and allowing users to link their accounts with digital wallets can make transactions swift and hassle-free.

Bespoke Notifications: Customizable notification settings empower users to stay in the loop without feeling overwhelmed by constant alerts.

What are the Various Challenges or Pitfalls to Address During Mobile Banking App Development?

When working with mobile banking app development, there are a few challenges that the administration should consider while making the software architecture choices for the project. It includes security measures, other government compliances, provisions to ensure a strong password for every customer, two-factor authentication factors, and other regulations. Additionally, suspicious channel payment blocking should be available. Lastly, the application must only store the necessary information to ensure a better customer experience while keeping the security of the user in mind.

How Do the Various Threats and Challenges Impact the Financial Sector?

Mobile banking apps can suffer from several challenges and threats. However, given the current situation of the market, they are also a must. Therefore, companies must be aware of these challenges

The Challenges Associated with Mobile Banking Apps

Security Breaches

Challenge: Security breaches in mobile banking apps can lead to unauthorized access, financial losses, and compromised customer data.

Example: In 2014, JPMorgan Chase experienced a massive data breach where hackers gained access to personal information of 76 million households and 7 million small businesses.

Data: According to a report by Verizon, 43% of data breaches in the financial sector involve hacking, and 86% of breaches are financially motivated.

Data Breaches

Challenge: Data breaches involve the theft or exposure of sensitive customer information, leading to identity theft, phishing attacks, and reputational damage for the bank.

Example: Equifax, one of the largest credit-reporting companies, suffered a data breach in 2017, exposing the personal information of 147 million Americans.

Data: According to the Identity Theft Resource Center, there were 1,862 reported data breaches in 2020, exposing over 300 million records.

Customer Trust Erosion

Challenge: Security breaches and data breaches erode customer trust. If customers don’t trust the mobile banking app, they are less likely to use it, hindering the bank’s digital transformation efforts.

Example: Wells Fargo faced a significant trust crisis in 2016 when it was revealed that employees had created millions of unauthorized bank and credit card accounts without customers' consent.

Data: A survey by Edelman Trust Barometer revealed that the financial services industry had a trust level of only 54% in 2021, indicating a significant trust gap.

Importance of Addressing These Issues

- Financial Losses: A data breach can cost millions in damages, legal fees, and regulatory fines. The 2017 Equifax breach settlement alone amounted to nearly $700 million.

- Regulatory Consequences: Failure to protect customer data can lead to severe penalties. For instance, the GDPR (General Data Protection Regulation) allows fines of up to €20 million or 4% of the global annual revenue for non-compliance.

- Reputation Damage: Trust is hard to regain once lost. A damaged reputation can lead to customer attrition, making it difficult for the bank to acquire new customers.

- Legal Consequences: Banks can face lawsuits from customers affected by data breaches, leading to additional financial strain and reputational damage.

Addressing the Issues

Robust Security Measures: Implement multi-factor authentication, encryption, and regular security audits to safeguard customer data.

Compliance: Stay updated with regulations (such as GDPR and local data protection laws) and ensure the app complies with industry standards.

Education: Educate customers about safe online practices to mitigate phishing risks.

Prompt Response: Have an incident response plan in place to swiftly address breaches, minimizing their impact.

Transparency: Be transparent with customers about security measures, data usage policies, and how their information is protected.

How to Build a Banking App – 10-Steps Comprehensive guide on mobile banking app development ?

To create the right mobile banking app, you must follow the process. Here is a step-by-step guide on how to approach the job:

Researching Away

Begin the process by researching your competitors to determine your needs. It includes considering your business model and determining the features that will benefit your users.

Create the Prototype

Once you have the needs in mind, create a prototype, listing the various elements of the application. It will allow you to have a picture in your mind and rectify it in the beginning. Because, after development, these changes can cost much more.

Security First

The team you choose to work for you must have experience in building a banking app. It is the only way to ensure that they will have the expertise needed to create a safe application.

User Interface and Experience

Then, make decisions related to the user interface and user experience. All the decisions must be geared towards creating a product that is helpful and useful for the clients.

Tech Stack Decisions

Depending on your needs, the technologies used for the development will vary. So, ask your vendor for suggestions of the tech stack most appropriate for your needs.

Coding Begins

Now, it is time to move towards the coding process. Hire a professional banking mobile app development company within your budget to get the job started.

Third-party Solutions, if any

Here, you can ask the software developers to add third-party solutions that might benefit your application.

Release the Product

After appropriate testing of the final product, it is time to let your users have a run of it. Upload the application on relevant platforms so that your users can download and start using the product.

Marketing Unabashedly

Once it is out in the open, it is time to market the product to every user and potential user you can find. Get more people to use the app and get their feedback on the product for further changes.

Maintenance, Improvement, and Updates

With the product already in the hands of the public, your responsibility revolves around maintaining the operations. Additionally, you need to make improvements based on the feedback received and dynamic needs. Finally, you must update the application to make it better.

Final Thoughts – Give your users the freedom to bank on their Terms

The cost of the final product, the tech stack, and the time it takes to bring your vision to fruition will depend on the requirements of mobile banking app development project. Currently, the digital revolution is disrupting the whole banki` lp your business stand out.

Get in touch with Seasia Infotech to learn more about our services and make the required arrangements to start your journey of digital transformation.

FAQ

a). What is the benefit of mobile app development services for banking?

Mobile app development services for the banking industry is essential to offer frictionless 24/7 access to users. It can also add to customer experience while offering a competitive advantage to the early adopters.

b). What is the scope of a mobile banking app?

A mobile banking app can be as complex or simple as needed. Generally, the mobile banking apps of today offer common banking services, payment options, card management, balance and statement checks, investment management, and more.

c). What can be done in a mobile banking app that can’t be done online?

Mobile banking apps and online banking services are similar in several services. However, they differ in accessibility. The application that you can keep on your phone, ready for you when you are out and about. On the other hand, online banking requires a bigger screen, and even if you can log in using your phone, the experience does not match the one provided by the application.

d). What is the cost of mobile banking application development?

There is no single answer to it. The cost of developing a mobile application will depend on how complex or simple the final product is. App complexity, the platform, security requirements, other integrations, and more contribute to the price. However, you can always get in touch with relevant vendors to understand the products they are willing to offer, at what time, and for what price.

Artificial Intelligence

Artificial Intelligence

Blockchain

Blockchain Cloud Computing

Cloud Computing Infrastructure

Services

Infrastructure

Services Metaverse

Metaverse QA

Automation

QA

Automation UI/UX

UI/UX