-

Apexlink

Real Estate

-

DLS

General Insurance

-

DMV

Government

-

Entiger

Fintech

-

GIS Mapping

Gas & Petroleum

-

HMS

Employee Benefit

-

HAWA

Government

-

Harley

Community

-

IHG

Hotel & Tourism

-

Sparkseeker

Humane Tech

-

Track Ninja

Sports

-

Response Vision

Disaster Management

- Artificial Intelligence

- Application Services

- Automation Services

- Cyber Security

- Chatbot Experts

- Data Analysis

- Data Warehouse Services

- Machine Learning

- Digital Commerce Services

- Digital Transformation

- Infrastructure Service

- IT Support

- IT Consulting

- IT Outsourcing

- IOS Development

- Android Development

-

Cross Platform Development

-

Gaming App Development

A lot of businesses do not quite understand the positive impact a well-executed CRM system can have on their business, and thus, make the mistake of skipping it. Here’s the secret no one tells you: if you run a business where you provide products or services to the customer, you could certainly benefit from CRM software. Being used widely in almost every industry, CRM in banking plays an equally important role by helping banks manage customer interactions and relationships across all channels.

CRM systems in banking give these financial institutions a comprehensive view of their leads and customers while also recording all key details and activities. In addition to more refined customer relationship management, CRM software empowers banking professionals to address the needs and concerns of buyers more efficiently, ultimately contributing to building more valuable and rewarding relationships with them.

Before we dive deeper into the sea of advantages that CRM for banking brings to the table, let’s identify major challenges the banking sector faces.

Common Challenges that Slow Down the Banking Sector

Embracing the capabilities of digitization is no longer a choice for businesses, and this applies to the banking sector as well. In addition to loss of trust and frustration among customers, lack of the right digital tools often leads to operational issues as well.

If you are yet to embrace CRM for banking, there are chances that you are already facing the following challenges:

- Dissatisfied customers because of your inability to provide them with the convenience of digital services.

- Inefficiency in processes because of how susceptible manual processes are to delays, errors, and higher costs.

- New and innovative FinTech industries companies are transforming the banking sector with their digital-first business models and are posing a threat to the existence of traditional banks that refuse to upgrade.

- As you take little steps toward digitization, you will also have to prepare yourself to stand tall against threats like cyber-attacks and data breaches.

- If your primary mode of operation is offline, there are always going to be rigid limits around how efficiently and to what extent you can scale.

The good thing is all these challenges can be solved efficiently by incorporating banking CRM solutions into your business.

With CRM banking software, you will be able to deliver unparalleled customer service that will not only attract new customers but will also improve retention rates.

More Reasons to Execute CRM in Banking

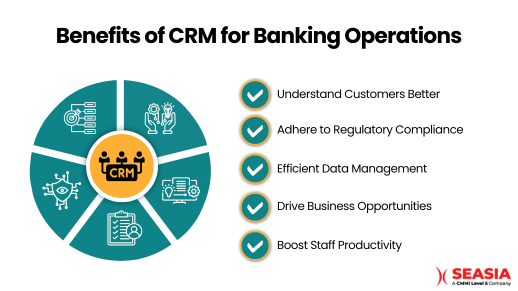

There are several other benefits of utilizing CRM in banking.

Get to know your customers better and strengthen your relationship with them.

CRM in retail banking does a lot more than just storing data. The thorough information about your customers is used by such software to garner valuable insights like their preferences, financial aspirations, and more. By letting you provide personalized solutions to your customers on the basis of these insights, CRM in banking helps you in enhancing their overall experience, and thus build a stronger relationship with them.

Make sure you are strictly adhering to regulatory compliances.

Staying in line with regulatory compliances like PCI-DSS and GDPR is crucial for efficient customer relationship management in banking sector. CRM for banks helps ensure that this condition is being met for the safety and security of customer data.

Manage your data more efficiently.

Banking institutes need to handle large volumes of data regularly, and doing so while keeping track of the regulatory compliances can be difficult. By centralizing and organizing this customer data, CRM in banking empowers banks to make informed, data-driven decisions.

Drive new business opportunities by driving more leads.

CRM software for banks is capable of identifying and prioritizing prospects based on their financial profiles and spending behaviors. By acting upon the software generated insights, banks can launch tailored marketing campaigns that resonate with the target audience and result in potential leads. In addition to that, bank CRM software can also identify untapped market segments and uncover cross-selling opportunities for you to expand your service offerings.

Take your staff productivity to the next level.

When you let the banking CRM software handle the difficult and time-consuming tasks such as streamlining workflows and automating routine tasks, the staff can instead work high-value activities like relationship building. Centralized access to customer data along with real-time insights enables your staff to resolve customer inquiries promptly.

And if you want to reap all these benefits by introducing CRM in banking, make sure your software comes equipped with the key features we’ve discussed in detail in the next section.

What to Look for in a CRM for Banks

Any useful banking CRM for banks needs to have the following features.

- It must offer a 360-degree view of your customers. This typically includes customer profiles, customizable templates, automated updates post interaction with the bank, interlinking of profiles wherever required, and more.

- CRM in banking streamlines lead and opportunity management like never before. In addition to capturing leads across different communication channels and automated distribution, you should look out for features such as AI-based lead prioritization, opportunity analysis, and lead qualification.

- Marketing campaign management is one of the key features of CRM in banking that lets to craft personalized campaigns based on user behavior while also analyzing their reaction to those campaigns. An advanced version of this feature will also let you conduct A/B testing for your marketing campaigns.

- Bank CRM software should also handle sales related tasks including goal setting, sales pipeline design, contract management, and automated reminders among others for smooth sales process management.

- Customer interaction management is another important aspect of a CRM in banking as it handles multichannel engagement, customer surveys, contact management, automated email distribution, and more.

- Other noteworthy elements are case management and customer self-service, security and compliance, and various analytics and reporting capabilities.

To add to a banking CRM’s capabilities, it can be integrated with other powerful third-party tools. Some of these are:

| Integration | Tools/Platforms | Benefits |

| AI-Powered Analytics and Insights | IBM Watson, Microsoft Azure AI | Predictive analysis, customer behavior insights, personalized banking experiences |

| Omnichannel Communication Platforms | Twilio, Zendesk | Unified customer communication across multiple channels (email, SMS, chat, social media), improved response times, enhanced customer engagement |

| Financial Management Tools | Mint, Yodlee | Real-time financial tracking, budgeting assistance, better financial planning for customers |

| Marketing Automation | HubSpot, Marketo | Targeted marketing campaigns, automated workflows, improved lead nurturing and conversion rates |

| Document Management Systems | DocuSign, Adobe Sign | Secure document storage, easy document retrieval, streamlined approval processes, electronic signatures |

| Customer Feedback and Survey Tools | SurveyMonkey, Qualtrics | Real-time customer feedback, enhanced customer satisfaction, data-driven improvements |

| Fraud Detection Systems | SAS Fraud Management, FICO Falcon | Real-time fraud monitoring, predictive analytics to prevent fraudulent activities, enhanced security |

| Payment Gateways | PayPal, Stripe | Seamless payment processing, multiple payment options, secure transactions |

| Core Banking Systems | Temenos, Finastra | Real-time account management, transaction processing, improved operational efficiency |

| Social Media Integration | Hootsuite, Buffer | Social listening, customer engagement, reputation management |

| Chatbots and Virtual Assistants | Drift, Intercom | 24/7 customer support, instant query resolution, enhanced customer service |

| Business Intelligence (BI) Tools | Tableau, Power BI | Advanced data visualization, reporting, data-driven decision-making |

| Credit Scoring Systems | Experian, Equifax | Accurate credit assessments, personalized lending offers, risk management |

| Identity Verification Services | Jumio, ID.me | Enhanced KYC processes, reduced fraud, secure customer onboarding |

| Blockchain Technology | Ethereum, Hyperledger | Secure transactions, transparent records, reduced fraud |

Whether to Buy Banking CRM Software or to Opt for CRM Software Development?

Even though we have hundreds of options when it comes to choosing the most suitable banking CRM software, the safest way out is investing in CRM software development (if your budget and project timeline allows that, of course!). While off-the-shelf options for CRM for banking can be deployed quickly with a low setup cost when compared to custom banking CRMs, they generally offer standard features with limited scope of customization.

As far as the custom banking CRM software development costs are concerned, it may require an investment of anywhere between $150,000 to $350,000 depending upon the functionality, integrations, complexity, and other important factors.

Step by Step Implementation of CRM in Banking

When you partner with a banking software development company for implementing your banking CRM, they generally follow the below-mentioned approach.

Step 1

They evaluate your present procedures to identify the processes and modules that need to be worked upon.

Step 2

Find out the bottlenecks in your workflows and examine the impact of your current processes on your customers and business success.

Step 3

Reassess your organization’s requirements to decide on the modifications required to meet your goals and expectations.

Step 4

Define and create new processes that are ideal for automation by integrating the latest tools and techniques for CRM in banking.

Step 5

Put the new workflows to the test and train the staff to work with those new procedures to ensure a smooth transition.

Why choose Seasia Infotech for implementing CRM in banking?

Seasia Infotech is a top-rated banking software development company that can help you take your financial institution towards greater success by implementing CRM in banking. We have plenty of experienced working with CRM platforms like Salesforce Financial Cloud, Odoo, Microsoft Dynamics 365, and Creatio, and can assist you with choosing the most appropriate platform for your needs.

Whether you’re looking for banking CRM implementation or banking CRM consulting, our CRM experts are here to show you the way. Contact us now to get started!

Frequently Asked Questions

What is CRM in banking?

CRM in banking is a process that helps banks build and strengthen relationships with their customers. Banking CRM software provides these financial institutions with valuable insights along with a 360-degree view of their existing and potential customers. This software can be customized to suit the specific need of a bank or organization.

What are the 3 types of CRM?

CRM software solutions is typically classified into three categories – operational CRM, analytical CRM, and collaborative CRM.

What is the scope of CRM in banking?

Banking CRM software allows the industry professionals to serve their customers better through personalized experiences by giving them a data-driven, comprehensive overview of their needs and expectations.

What is the future of banking CRMs?

The demand for banking CRMs will grow significantly over the next few years as the industry gets more competitive in terms of offering the best possible banking experience to their customers. This growth will be powered by AI-based personalization, data-driven decision making, and omnichannel customer engagement.

Artificial Intelligence

Artificial Intelligence

Blockchain

Blockchain Cloud Computing

Cloud Computing Infrastructure

Services

Infrastructure

Services Metaverse

Metaverse QA

Automation

QA

Automation UI/UX

UI/UX