-

Apexlink

Real Estate

-

DLS

General Insurance

-

DMV

Government

-

Entiger

Fintech

-

GIS Mapping

Gas & Petroleum

-

HMS

Employee Benefit

-

HAWA

Government

-

Harley

Community

-

IHG

Hotel & Tourism

-

Sparkseeker

Humane Tech

-

Track Ninja

Sports

-

Response Vision

Disaster Management

- Artificial Intelligence

- Application Services

- Automation Services

- Cyber Security

- Chatbot Experts

- Data Analysis

- Data Warehouse Services

- Machine Learning

- Digital Commerce Services

- Digital Transformation

- Infrastructure Service

- IT Support

- IT Consulting

- IT Outsourcing

- IOS Development

- Android Development

-

Cross Platform Development

-

Gaming App Development

The global shift toward a cashless economy has accelerated in recent years. The key drivers of this shift are rapid technological advancements, evolving consumer preferences, & heightened concerns over security and hygiene (especially after the pandemic). At the heart of this transformation are digital wallet applications. These are secure, user-friendly tools that promote smooth payments & money transfers, in addition to a growing list of value-added services.

Digital wallets have now become a cornerstone of the changing fintech environment. According to a study by Statista, the total transaction value in the digital payments segment through digital wallets is expected to show an annual growth rate of around 14.9%, resulting in a projected total amount of USD 5400 billion by 2027.

Let us walk you through the rise of digital wallet app development and the contributing factors. We will cover its benefits for businesses and consumers, key features that drive adoption, and how Seasia Infotech can help you build a future-proof, best digital wallet solution.

What is a Digital Wallet?

A digital wallet (or e-wallet) is a software-based system that securely stores users’ payment information and passwords for numerous payment methods and websites. Through fintech app development, it enables users to make electronic transactions quickly, whether for online or in-store purchases. Beyond just storage of debit/credit cards, best digital wallets today offer features like:

a. Peer-to-peer (P2P) transfers

b. Bill payments

c. Rewards and loyalty management

d. Cryptocurrency transactions

e. Budgeting tools

Digital wallets play a rather critical role in a cashless society. The key aspects of the role they play are:

a. Convenience: Consumers can make payments anytime, anywhere, bypassing the need for physical wallets & cash.

b. Speed: Transactions occur almost instantaneously, reducing waiting time at checkout.

c. Security: Biometric authentication, tokenization, & encryption significantly reduce fraud.

d. Financial Inclusion: Digital wallets can cater to underbanked & unbanked populations, improving access to financial services.

Some of the best mobile wallets we have today are Apple Pay, Google Pay, Cash App, and Venmo. Now, let’s take a look at the main drivers that are promoting the adoption of digital wallets across the globe.

Key Drivers Propelling Digital Wallet Adoption

a. Smartphone Penetration

As smartphone usage soars globally, more people can access apps that facilitate instant payments and money management. With over 7 billion smartphone users globally, the number of digital wallets users is also bound to grow enormously.

b. Contactless Payments and NFC

NFC and QR code-based payments have become highly popular due to their convenience and hygiene factors. Mobile banking app development is leading this revolution.

c. E-commerce Boom

Online marketplaces incentivize digital wallet usage through cashbacks, loyalty points, and instant checkouts.

d. Enhanced Security

Multi-factor authentication, biometric login, and PCI-DSS compliance have made digital wallets more secure than ever before.

e. Regulatory Support

Governments worldwide are promoting digital transactions to improve transparency, reduce tax evasion, & increase financial inclusion.

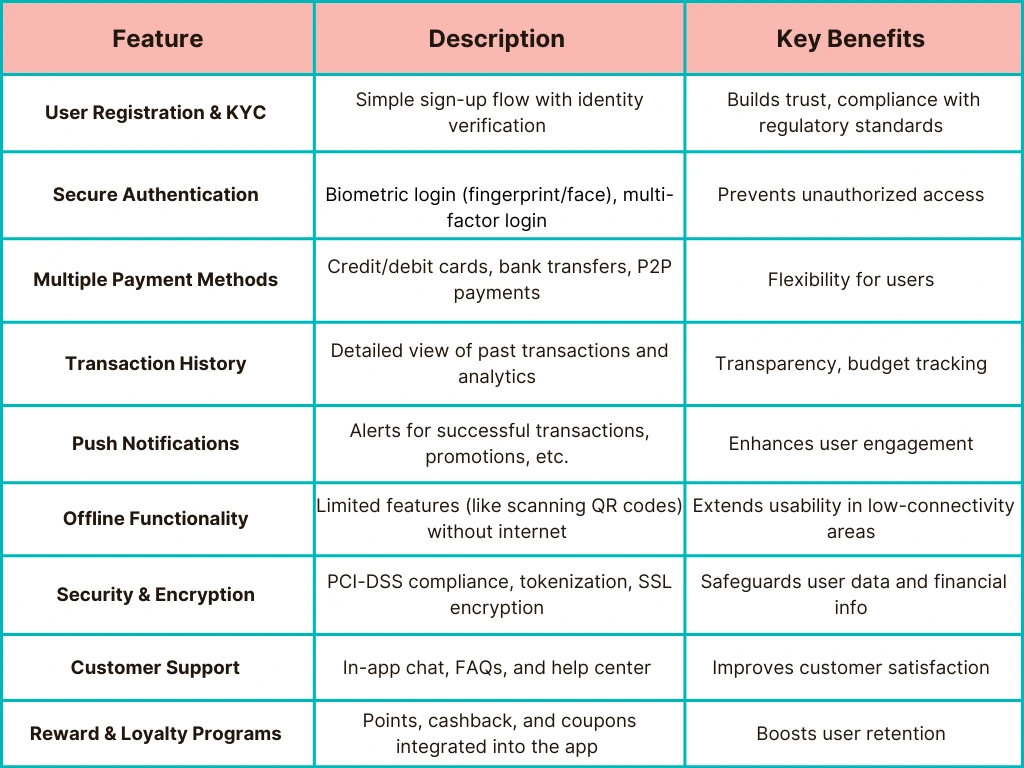

Must-Have Features in Digital Wallet App Development

Development of top digital wallets requires blending user-centric design with robust security practices. Below is a snapshot of the essential features that you must incorporate in your digital wallet during app development, and their respective benefits:

Security Best Practices

Security is paramount in digital wallet app development. Here are some best practices that form the backbone of a safe and compliant solution:

a. Encryption & Tokenization

- Ensure all sensitive data (like card numbers) is encrypted or tokenized.

- Comply with PCI-DSS guidelines to handle payment data securely.

b. Fraud Detection Algorithms

- Implement AI/ML models to monitor and flag unusual activity.

- Use real-time alerts for suspicious transactions.

c. Multi-Layer Authentication

- Combine biometric checks with one-time passwords (OTPs) or PIN to reduce fraud.

d. Regulatory Compliance

- Adhere to local and international regulations (e.g., GDPR in the EU, HIPAA for health-related payments if applicable).

Benefits for Businesses and Consumers

For Businesses

a. Increased Customer Engagement

Offering a proprietary digital wallet solution fosters brand loyalty and encourages repeat transactions.

b. Data-driven Insights

Access to transactional data from electronic wallets helps in personalizing offers, improving customer service, and making informed decisions.

c. Cost Optimization

Digital payments reduce overhead costs associated with cash handling and paper-based processes.

d. Global Reach

A well-designed digital wallet app can cater to international markets, expanding business footprints.

For Consumers

a. Convenience & Speed

No need to carry multiple cards or cash; transactions are quick and seamless.

b. Enhanced Security

Digital wallets often provide better security than physical wallets, thanks to encryption and biometric locks.

c. Rewards and Loyalty

Integrated reward programs offer immediate and tangible benefits like cashbacks and discounts.

d. Budget Management

In-app insights and analytics help users track spending and budget effectively.

The Future of Digital Wallets

The evolution of digital wallet apps goes beyond mere transactions. Here are a few fintech trends setting a strong foundation for the future:

a. Cryptocurrency Integration

Adding crypto support extends payment options and capitalizes on the growing DeFi ecosystem.

b. AI-driven Personalization

Recommending financial products, optimizing spending categories, and offering personalized deals through AI.

c. Wearables and IoT

Payment-enabled wearables (smartwatches, fitness trackers) and IoT devices will further drive adoption of digital wallets.

d. Omnichannel Payment Experience

Unified shopping experiences across channels—web, mobile, in-store—powered by a single e-wallet solution.

Why Choose Seasia Infotech for Your Digital Wallet App Development

Seasia Infotech has been at the forefront of fintech innovation for several years now, delivering cutting-edge solutions for clients worldwide. Here’s what sets us apart:

a. Expertise in Fintech: Our specialized team understands the nuances of secure payment integrations, regulatory compliance, and user experience design.

b. Agile Development Approach: We use agile methodologies to ensure rapid development, continuous feedback loops, and a smoother go-to-market process.

c. Robust Security Frameworks: Our solutions are built on stringent security standards and incorporate the latest encryption protocols.

d. Scalable & Flexible Architecture: Our modular design ensures that your digital wallet can evolve to incorporate new technologies like blockchain and AI.

e. 24/7 Support & Maintenance: We offer round-the-clock support to ensure seamless operations, quick issue resolutions, and regular updates.

To Sum It Up

The cashless economy is not a trend, but in fact, the inevitable future of global finance. Businesses that invest in digital wallet app development stand to gain a competitive edge by offering secure, convenient, and innovative payment experiences. Whether you’re a startup aiming to disrupt the market or an established enterprise looking to enhance customer loyalty, a robust digital wallet is a game-changer.

Ready to empower your customers with a next-gen digital wallet solution?

Contact Seasia Infotech today, and let us help you design, develop, and deploy a future-focused digital wallet app that keeps you ahead in the constantly innovating cashless world.

Frequently Asked Questions

How does a digital wallet app work?

Mobile wallet apps store payment credentials and user data securely. They use encryption and tokenization to protect transactions. Users can make contactless payments by authenticating within the app and transmitting a secure token.

What features should I look for in a digital wallet app?

Look for tight security, broad payment support, real-time transaction tracking, intuitive UI/UX, rewards integration, and compatibility across different devices in your wallet apps.

What are the factors affecting the cost of developing a digital wallet app with the latest technologies?

Cost of digital wallet app development may vary depending upon app complexity, security/compliance requirements, platform support, third-party API fees, and user support among other factors.

Artificial Intelligence

Artificial Intelligence

Blockchain

Blockchain Cloud Computing

Cloud Computing Infrastructure

Services

Infrastructure

Services Metaverse

Metaverse QA

Automation

QA

Automation UI/UX

UI/UX